Facebook? Never heard of it

Finding alpha in clean energy; earnings divergence means discernment; ESG breaks up with Big Tech. Or, Big Tech breaks up with Big Tech.

From the top

📊 Earnings season is here, and it’s a mixed bag. Case in point: Alphabet and Meta, whose results diverged wildly despite operating in/conspiring to make a duopoly of the same sector. While some ESG areas outperformed, renewables are having a rough ride after a rough year (in a market that rose 20%, Orsted fell 40%, Vestas 37%). Artemis’s Simon Edelsten blames government funding for driving down premiums and fuelling competition. Now hedge funds are circling in anticipation of rate rises.

🔬 But government support means renewables are here to stay. So where do you go for alpha? “It’s the second order of ideas that are of interest,” says Barclays, which is looking beyond traditional clean energy for “entrepreneurs using different techniques.” Familiar? Larry Fink predicted the next 1,000 unicorns will be “sustainable, scalable innovators: startups that help the world decarbonize.” The technology they pioneer will be the sine qua non of Big Oil if Big Tobacco is any clue.

🗳️ Through engagement, investors may bridge the transition. Lumi reports record AGM attendance in 2021, up 70% on 2020, as a quarter of companies faced more activism and votes against resolutions. Last year’s Engine No.1 win—combined with evidence blacklisted companies continue to operate just fine—are giving engagement an edge over divestment. But scrutiny begets scrutiny: Majority Action finds Climate Action 100+ is “systematically undermined” by the voting actions of its signatories.

👩💻 Many Big ESG Funds Are Just Glorified Market Trackers with a tech tilt, says Bloomberg. (We said it first.) Although, it’s not a new argument: Reflecting on 12+ months of ESG criticism, Morningstar finds superficial Silicon Valley vanilla-ness is a common charge. The answer, as ever, is better data, but that brings us to a second question: how do you weaponise good data? Probably not via traditional index funds. PwC’s latest report indicates the end game is bespoke indices—not passive ones.

👩⚖️ Investor demand and regulatory pressure is a sentence ESG writers have semantically satiated into oblivion. Only now, as the two (finally) dovetail, there’s a new, very real challenge for companies: lawsuits. Climate litigation is on the rise, but it won’t stop there. Consider codes of ethics. Shareholders want codes of a high standard, and so companies overpromise deliver. But, in an “everything-is-securities-fraud” era, any deviation is ammo to sue. TL;DR: Proving (or disproving) ESG commitments = $.

Meta’s terrible, horrible, no good, very bad day

ESG is breaking up with Big Tech. Or, rather, Big Tech is breaking up with Big Tech.

“The problem with the ESG win-win story,” says the FT’s Robert Armstrong, “is performance attribution.”

That was back in 2020. Sustainable funds were on a tear. Vanguard’s ESG US Stock ETF (ESGV) had returned 28% since its 2018 inception, whipping its broad-market ETF’s 17%.

“Look, however, at the holdings,” wrote Armstrong. The top seven, accounting for a quarter of the ESGV’s value, were Apple, Microsoft, Amazon, Facebook, Google and Tesla. “Tech has led the market this year,” he added. “But has ESG, really? And if tech stocks become overpriced and their prices crash, does that mean ESG is suddenly a bad strategy?”

We like the sector

Two years later, the answer to Armstrong’s question is taking shape. Early 2022 market jitters hit Big Tech disproportionately. Impending interest rate hikes will be unforgiving to ESG faves such as clean energy and tech, whose value is predicated on bright futures but weak earnings. ESGV has fallen 8.83% YTD: 2 percentage points more than the S&P 500 and 1 percentage point more than the Russell 3000.

But a soft spot for Silicon Valley isn’t the biggest problem for ESG funds, reports Bloomberg—or rather, it is the biggest problem in that it’s the only distinguishing problem, because ESG funds are “Glorified Market Trackers.” Which is a problem.

We’ll get back to that. For now, however, Armstrong’s question. If you were to answer a couple of weeks ago (which we sort of did), when tech stocks were down across the board, the answer would probably be well, yeah, kind of. Good time to hype value.

On the back of this week’s earnings, however, the answer might have changed.

Pressure from all sides

The results of Meta/Facebook, Alphabet/Google, Apple and Amazon have never before diverged so violently. Given the size of the companies, and those swings, you could look at the relative results as an indicator of what will endure (☁️) and what’s at risk (whatever Zuckerberg’s selling).

They’re also a strong indicator for sustainable investing.

ESGV, like most ESG funds, dropped Meta from its top holdings sometime after Armstrong’s article. We found Meta comprised 1.33% of non-sustainable versus 0.67% of sustainable funds as of last year. But less ownership doesn’t mean less influence: Meta’s disappointing results speak to the pressure ESG has exerted through all avenues. Namely:

Competition is heating up. But Meta can’t pivot, because it can’t even buy a GIF platform without regulatory scrutiny.

Users declined for the first time. But Meta can’t attract fellow_kids, because its reputation is so badly tarnished.

Finally, and most significantly, targeted advertising is its lifeblood. And so Meta took a 25% share price and $10BN revenue hit, because Apple introduced its App Tracking Transparency feature to protect iOS users’ data.

Regulatory and consumer pressures are features of a market where extra-financials matter, in part a consequence of investor action. The Apple development, Meta’s biggest headache, is a direct result of investor action. Tim Cook introduced App Tracking Transparency last year, in response to an investor question about privacy and human rights, on a Q&A call where almost half of shareholders’ questions related to social and environmental impact.

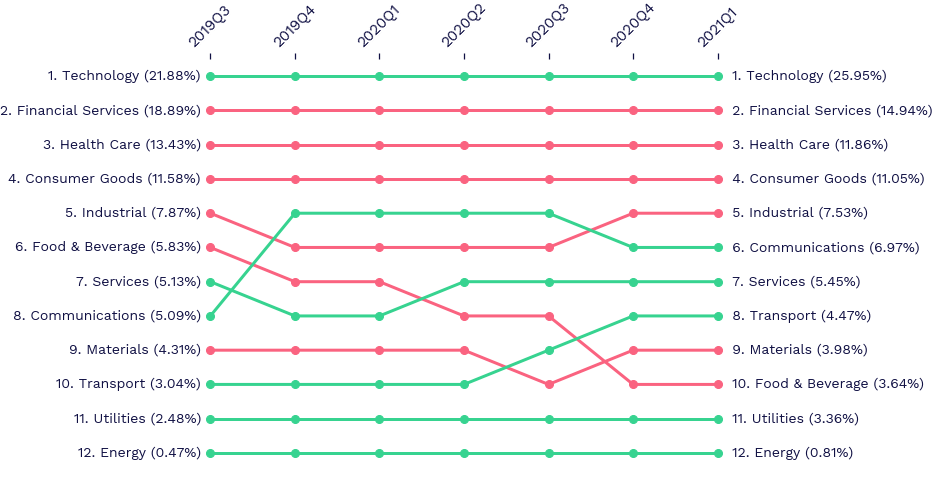

Fig.1: Sustainable fund vs. non-sustainable fund sector exposure evolution

Time to get picky

If tech stocks are correlated and investors are equitably exposed, then sure, a sustainable strategy is only as good as Big Tech. But that’s no longer the case. Investors were growing more discerning and aggressive from an ESG position already; market volatility will force greater selectivity from a performance position.

All of which gels nicely with what end-clients want, which is, according to PwC’s latest ETF report, “bespoke indices and tracking areas that investors are really, really interested in.”

Swathes of the population have spent two years in lockdown, learning how to invest, and ten years reading dire social and environmental headlines. They want more than Glorified Market Trackers, particularly if the market being tracked can’t even promise reliable returns. That demand is “driving innovation and moving ETFs away from the historic passive indices we have seen.”

Index and sustainable investing are the twin stars of this bull market. When it moves to the next stage, the big opportunity will be how the two approaches blend and grow: ideally, as bespoke, innovative financial products with a sophisticated, impactful extra-financial lens.